Corporate Governance

Risk Management

Structure and Objectives

LIBANK’s risk management structure provides a solid approach to risk control and management across the bank under an internal corporate governance.

It enables LIBANK’s management to effectively deal with uncertainty and associated risk and opportunity, enhancing the capacity to build value for its customers and shareholders.

The Risk Management is responsible for carrying out Board directives, including implementing strategies and policies and establishing an effective system of internal controls to protect LIBANK from unanticipated loss by providing systematic risk analysis, developing techniques to reduce potential exposure to loss.

The Board of Directors either directly or indirectly through the board risk committee, ensures that decision making is aligned with the bank’s strategies and risk appetite.

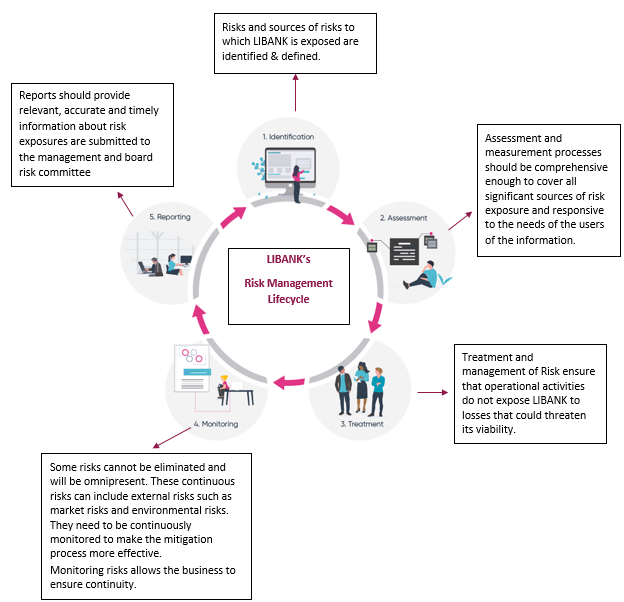

Risk Management Lifecycle

Risk management seeks to monitor the business risks and to keep risks within acceptable limits. When risks are properly managed, the benefits to be gained from those risks can be maximized, by accepting, reducing, eliminating, mitigating, or transferring the risk associated with any activity. In all circumstances, all activities giving rise to risk must be identified, measured, managed and monitored. Thus, risk management may be viewed as a “life cycle” which includes the following 5 cycles:

Risk Appetite, Assessment and Mitigation

Risk appetite, established by management with oversight of the Board of Directors, is a guidepost in strategy setting. LIBANK expresses its risk appetite as the acceptable balance of growth, risk, and return, or as risk-adjusted shareholder value-added measures.

There is a relationship between LIBANK’s risk appetite and its strategy. Usually any of a number of different strategies can be designed to achieve desired growth and return goals, each having different risks. An efficient risk control and management can detect earlier any risks which can be escalated to higher management and properly mitigated on time.

LIBANK, similar to other investment banks, is exposed to a variety of risks which are managed through a comprehensive risk management framework that integrates risk management into daily business activities and strategic planning. This safeguards the bank’s financial strength by promoting the identification, measurement and control of risks at all levels of the organization.

With a determination to comply fully with all existing regulations, LIBANK has set up an internal-control system in line with its strategic plan, as well as with its values and risk culture.